Since 2001 ........... Remade in June 2008 ........... Latest version since January 2022

Monday, October 25, 2010

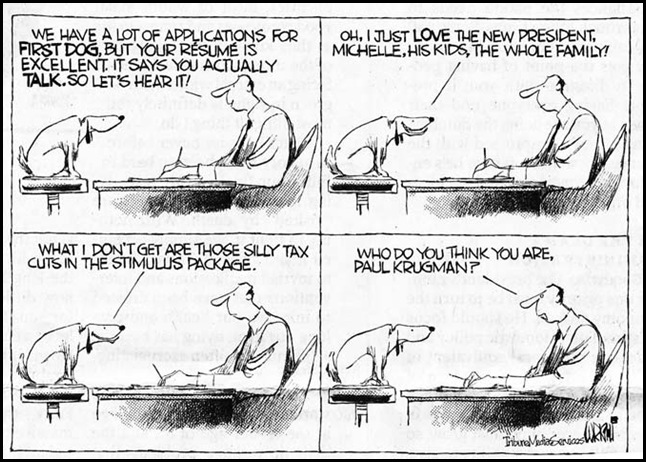

Will someone please shut Krugman up

Even before I get to the content, I could not understand why there is no question mark at the end of the headline :)

About the content itself, it is a squabble over the Lib-Con government's recent decision in favor of massive budget reductions. Cameron is doubling down on a gamble that such reductions during this feeble recovery will actually do Britain good. Krugman blasts that in his column and, hence, the response from Daily Telegraph, which is typically right of the political/economic center.

I suppose we will know in five years whose policy decisions turn out to be the correct ones.

As far as I am concerned, I yet again wonder if Krugman is diluting his value by pontificating a tad too much. Even if Krugman is always correct, it might become like the nerdy guy in the class who always puts his hand up and provides the correct answer while the rest of the class begin to hate him for being so smart :)

So, from a PR perspective, if not for the sake of content, perhaps Professor Krugman ought to chill for a while?

Monday, March 01, 2010

I am thankful that I am not unemployed

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.More than six million people unemployed for more than half-a-year and still not discouraged enough and are looking for jobs! What a recession this has been ....

According to the BLS, there are a record 6.31 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 4.1% of the civilian workforce.

Krugman messes up my mind some more:

We’ve been through the second-worst financial crisis in the history of the world, and we’ve barely begun to recover: 29 million Americans either can’t find jobs or can’t find full-time work.So, can we help out the unemployed?:

House Speaker Nancy Pelosi took a shot across the Capitol at Sen. Jim Bunning, slamming the Kentucky Republican for his one-man filibuster of unemployment benefits, which are due to expire Sunday.Adds Megan McArdle:

"It is really hard to understand why one senator in the United States Senate is holding up the extension of unemployment insurance at this time," said Pelosi. "But he is, and I'm pleased that the Senate Democrats are trying to make a move to dislodge that."

His cunning plan to put a hold on the reauthorization of unemployment benefits until the Democrats agree to fund them out of existing stimulus dollars will not do much good, and it could do great harm.

Thursday, January 07, 2010

Congo's stimulus plan: An AK-47 for everyone!

It is a tragedy that the war and killings go on in the Congo, while we seem to be far more interested in Star Wars and Avatars .... oh well, I suppose we will continue to ignore Africa a lot more ...

Congo Approves Economic Stimulus Package Of AK-47 For Every Citizen

Wednesday, November 04, 2009

Hurry up: FREE golf carts

An excerpt from the WSJ: (ht)

"The Golf Cart Man" in the Villages of Lady Lake, Florida is running a banner online ad that declares: "GET A FREE GOLF CART. Or make $2,000 doing absolutely nothing!"

Golf Cart Man is referring to his offer in which you can buy the cart for $8,000, get a $5,300 tax credit off your 2009 income tax, lease it back for $100 a month for 27 months, at which point Golf Cart Man will buy back the cart for $2,000. "This means you own a free Golf Cart or made $2,000 cash doing absolutely nothing!!!" You can't blame a guy for exploiting loopholes that Congress offers.

The IRS has also ruled that there's no limit to how many electric cars an individual can buy, so some enterprising profiteers are stocking up on multiple carts while the federal credit lasts, in order to resell them at a profit later. We should note that some states, such as Oklahoma, have caught on to the giveaway and are debating whether to cancel or limit their state credits. But in Congress they're still on the driving range.

... If this keeps up, it'll soon make more sense to retire and play golf than work for living.Yes, true even if sounds way too bizarre to be true!

Saturday, October 17, 2009

The ticking deficit bomb

NY Times:

Economists generally agree that annual deficits should not exceed 3 percent of the G.D.P., and that is the level President Obama had vowed to reach by the end of his first term in 2013.

But subsequent spending and tax cuts to stimulate the economy, and lower-than-expected revenues as the recession deepened before bottoming out, combined to push the administration’s deficit forecast to 4.6 percent of G.D.P. for the fiscal year 2013.

At 10 percent of the gross domestic product, the 2009 deficit is the highest since the end of World War II, when it was 21.5 percent. At that level, it already has become a bigger economic and a political issue than any time since the late 1980s.

Wednesday, August 19, 2009

Greenback Emissions

Unchecked carbon emissions will likely cause icebergs to melt. Unchecked greenback emissions will certainly cause the purchasing power of currency to melt. The dollar’s destiny lies with Congress.Warren Buffett in the NY Times

Other than the fact that this is Warren Buffett, well, there is nothing new in this op-ed. Not well written either--way too many metaphors, and not consistent metaphorical descriptions either. He starts with greenback emissions, then sprinkles the rest of the essay with many more ....

To a large extent though, I prefer the Bill Gates approach--he does not write op-eds nor does he appear to want to pontificate. I mean, the more these guys do the talking and opinion writing, hey, even fewer would then want to know what we talkers/writers have to say :-)

Tuesday, August 18, 2009

On Obama's High speed rail plan

That was VP Biden's remarks back in April to launch the administration's vision for high speed rail.

So, four months later, what do we think?

First, here is Sam Staley at Reason:

Staley's bottom line is that the high speed rail plan fails as a stimulus program and does not create jobs.For transportation investments to have a meaningful economic impact, they will need to cost-effectively improve America's ability to move goods, services, and people from one place to another. High-speed rail doesn't do that. It is an extremely costly way to achieve limited portions of these goals, and it inevitably fails as a broad-based solution to the country's transportation challenges.

In the end, high-speed rail's contribution to the economic recovery and the nation's economic productivity is being oversold. Elected officials, from Rep. Cantor to President Obama, would do a far greater service to the public's understanding of the economy if they would focus on economic fundamentals, not glitzy boutique policy programs that will inevitably fail to meet grandiose expectations they have created for them.

Ed Glaeser looks at whether the proposed high speed rail would help America's other great problems--sprawl.

For illustrative purposes, Glaeser considers the Dallas-Houston corridor, which, as he points out, is not in the Obama plan. Glaeser notes that:

Despite the lack of any positive evidence linking centralization to high-speed rail, I certainly accept that there is a great deal of uncertainty. To give rail the benefit of the doubt, I’ll assume that high-speed rail will cause 100,000 households to switch from suburb to city in both Dallas and Houston. This change would create extra, annual environmental benefits of $29.7 million. These benefits would be real, but they would still do little to offset the $524 million or $401 million net annual loss discussed above.What do I think? High speed rail is so 19th century a solution for a 21st century Great Recession!

Thursday, August 13, 2009

Monday, July 27, 2009

The sound of the Chinese bubble bursting?

The new twist to this story, which maybe I missed before but I read for the first time now, is this:

[Don't] confuse fast growth with sustainable growth. Much of China's growth over the past decade has come from lending to the United States. The country suffers from real overcapacity. And now growth comes from borrowing -- and hundreds of billion-dollar decisions made on the fly don't inspire a lot of confidence. For example, a nearly completed, 13-story building in Shanghai collapsed in June due to the poor quality of its construction.

This growth will result in a huge pile of bad debt -- as forced lending is bad lending. The list of negative consequences is very long, but the bottom line is simple: There is no miracle in the Chinese miracle growth, and China will pay a price. The only question is when and how much.

Read the complete essay for how this argument is built up; pretty fascinating.

Thursday, May 28, 2009

Healthy states, not weak states, getting stimulus?

States hit hardest by the recession received only a few of the government's first stimulus contracts, even though the glut of new federal spending was meant to target places where the economic pain has been particularly severe.The report has an interactive map that is quite good. According to that map, Oregon's jobless rate is 12%, and the per capita stimulus funding so far is $2.12. In neighboring Washington, with a much lesser unemployment rate of 9.1%, per capita stimulus funding thus far is a whopping $216.02!Nationwide, federal agencies have awarded nearly $4 billion in contracts to help jump-start the economy since President

Obama signed the massive stimulus package in February. But, with few exceptions, that money has not reached states where the unemployment rate is highest, according to a USA TODAY review of contracts disclosed through the Federal Procurement Data System.In

Michigan , for example — where years of economic tumult and a collapsing domestic auto industry have produced the nation's worst unemployment rate — federal agencies have spent about $2 million on stimulus contracts, or 21 cents per person. InOregon , where unemployment is almost as high, they have spent $2.12 per capita, far less than the nationwide average of nearly $13.That money "is needed nowhere more than it is needed in Michigan," says Leslee Fritz, a spokeswoman for the Michigan Economic Recovery Office, which is coordinating stimulus efforts in that state. She said officials are generally satisfied with the pace of federal aid, but added, "We certainly feel very intensely the need to move quickly."

The $787 billion recovery package was intended to help turn around the economy using federal money to create jobs, especially in places where the recession has taken the most severe toll. Most of that money goes directly to states to pay for work such as highway repairs, but federal agencies also will spend billions of dollars to do everything from fixing runways and improving national forests to cleaning up nuclear waste.

Saturday, March 07, 2009

Recession, trade limits don’t mix

I am not surprised at all that the stimulus package has “buy American” provisions in it. I suppose congressional leaders were reflecting the prevailing mood among the U.S. public, and even among most students in my introductory geography course.

My students’ “buy American” discussion was in the context of an assignment they had completed. I had asked them to pick 20 items at random in their apartments and note the countries where they were manufactured. They then had to identify any patterns they observed in the data.

As one would guess, about 50 percent to 60 percent of the goods they owned were manufactured in China. Barely a fifth of their “stuff” was made in the good ol’ USA. Some students were surprised to note that they owned things made in countries they did not even know existed.

The more we discussed the data, the more they seemed to be concerned about goods flooding this country from somewhere else. It didn’t take long before some of these students in an introductory geography class began wondering if we need to protect and encourage “our” businesses and not rely so much on China or other foreign countries.

The “buy American” provisions in the stimulus package reflect these same concerns. The package requires that only U.S.-made goods, particularly iron and steel, be used in public works and building projects that will be paid for by the stimulus dollars. Financial firms that are on government life support will not be able to hire foreign labor, either.

My typical response to students is to rely upon local examples. I ask them whether other countries might feel that importing planes manufactured by Boeing precludes the growth of an aircraft industry within their borders. I ask whether the import of Hollywood films is wiping out other countries’ native movie industry. I ask whether my students would be OK with those countries not buying our movies and planes.

It becomes clear that trade is a way of life, and imports and exports are basic characteristics of modern and successful economies — even during recessions. On the other hand, if countries implement a variation of autarky — the notion that a country should be self-sufficient and not engage in international trade — then the results are unfavorable.

India, during my formative years, practiced a version of “buy Indian” through an elaborate and regulated system of import-substituting industrialization. In this system, it was nearly impossible to get access to goods manufactured in another country. It didn’t matter whether it was chocolate or cement or cars, importing meant extensive governmental red tape and even bribes.

Had India continued down that path, it would not have undergone the economic and technological revolution that it has. The much joked-about call centers would not have been sited in India. Neither would Thomas Friedman have coined the phrase “the world is flat.”

As I have noted in earlier columns, absolute poverty in India has not been eliminated, and many other problems persist. But I am confident that the situation would be worse had India not switched its economic gears from autarky to policies that actively encouraged greater participation in the global economy.

So much to my students’ disappointment, I am not keen on closing our economy, even if only partially, with “buy American” provisions.

Also, the current economic crisis is not merely American but global. We are at a stage where China’s imports have dropped almost by half, and the economic contraction in Japan makes our recession look tame. So I am equally worried that other countries might start imitating America with their own versions of “buy domestically.” It is no wonder then that other key global players, including China and the European Union, already have warned us that they will keep a close watch on American protectionism.

To a large extent, the way out of this recessionary hole is by adopting a global slogan of “just buy, baby,” similar to Al Davis’ old tagline of “just win, baby” in the Oakland Raiders’ heyday. It’s simply unwise to chant, “just buy American, baby.”

Published in The Register-Guard

Appeared in print: Sunday, Mar 8, 2009, page G3

Wednesday, February 25, 2009

Stimulus package will pay Manny Ramirez, too!

Scott Boras, the agent known for representing the highest-paid players in baseball, set another record for the game's largest contract when he finalized Manny Ramirez's $20 billion agreement with the United States federal government on Thursday. "Manny's .396 batting average last season with the Dodgers, as well as his playoff performance, proved that he is as important to this country as infrastructure projects, health care, and renewable energy development," Boras said during an interview, adding that Ramirez is especially satisfied with the indefinite length of the contract. ... " A clause in the contract states Ramirez could receive an additional $6 billion if he successfully saves the American auto industry.Well, that is not true--this is a satirical piece from, who else, The Onion :-)

The real story on Manny Ramirez' salary?

owner Frank McCourt and General Manager Ned Colletti made their latest pitch to Ramirez's representatives in a meeting at Dodger Stadium: two years, $45 million.

The proposed deal would pay Ramirez $25 million this season and includes a $20 million player option for 2010, according to baseball sources familiar with the negotiations who weren't authorized to speak publicly on the matter. Ramirez would be able to void the second year of the contract and re-enter the free agent market next winter.

Ramirez's agent, Scott Boras, was said to be informing Ramirez of the offer Wednesday evening and told the Dodgers that he could tell them of Ramirez's response as soon as this morning.

Tuesday, February 24, 2009

Thursday, February 12, 2009

Friday, February 06, 2009

Saying "I am an Argentinian" in Spanish?

Key leaders of the "Blue Dog Coalition" that represents the conservative wing of the House Democratic Caucus are now openly revolting against the stimulus package's spending proposals -- a stance that dramatically strengthens the hand of Republicans who, for obvious partisan reasons, hope to undermine Obama's popular appeal and ability to move on critical economic issues.No wonder then Niall Ferguson then points out the following (his entire column is a good read)The Blue Dog Coalition, which claims forty-seven House members, went public with its opposition to elements of the plan that Obama and Speaker Nancy Pelosi, D-California, are supposed to be promoting in a letter sent Thursday to the speaker.

The Western world is suffering a crisis of excessive indebtedness. Governments, corporations and households are groaning under unprecedented debt burdens. Average household debt has reached 141% of disposable income in the United States and 177% in Britain. Worst of all are the banks. Some of the best-known names in American and European finance have liabilities 40, 60 or even 100 times the amount of their capital.

The delusion that a crisis of excess debt can be solved by creating more debt is at the heart of the Great Repression. Yet that is precisely what most governments propose to do.

The United States could end up running a deficit of more than 10% of GDP this year (adding the cost of the stimulus package to the Congressional Budget Office's optimistic 8.3% forecast). Nor is that all. Last year, the Bush administration committed $7.8 trillion to bailout schemes, in the form of loans, investments and guarantees.

....

Just how much more toxic waste is out there? New York University economistNouriel Roubini puts U.S. banks' projected losses from bad loans and securities at $1.8 trillion. Even if that estimate is 40% too high, the banks' capital will still be wiped out. And all this is before any account is taken of the unfunded liabilities of the Medicare and Social Security systems. With the economy contracting at a fast clip, we are on the eve of a public-debt explosion. And similar measures are being taken around the world.

The born-again Keynesians seem to have forgotten that their prescription stood the best chance of working in a more or less closed economy. But this is a globalized world, where uncoordinated profligacy by national governments is more likely to generate bond-market and currency-market volatility than a return to growth.

There is a better way to go: in the opposite direction. The aim must be not to increase debt but to reduce it.

This used to happen in one of two ways. If, say, Argentina had an excessively large domestic debt, denominated in Argentine currency, it could be inflated away -- Argentina just printed more money. If it were an external debt, the government defaulted and forced the creditors to accept less.

Today, America is Argentina. Europe is Argentina. Former investment banks and ordinary households are Argentina. But it will not be so easy for us to inflate away our debts.

Robert Barro, an economics professor at Harvard, comes out swinging big time. I mean, big time. Read what he says about Krugman:

He just says whatever is convenient for his political argument. He doesn't behave like an economist. And the guy has never done any work in Keynesian macroeconomics, which I actually did. He has never even done any work on that. His work is in trade stuff. He did excellent work, but it has nothing to do with what he's writing about.Ouch. Will this qualify as a "bitch slap"? He does not have patience for most economists too:

Most economists haven't really been thinking about this issue, they haven't really focused on it. It's not their specialty. Most economists today, they haven't really been thinking about this kind of multiplier issue. Which goes back to that first question you asked about how come now we're so worried about this. I don't think most economists are focused on this, or that they're familiar with the empirical evidence. I don't think they've really worked on the theory. So I don't know, maybe they have some opinion that they got from graduate school or something.So, if there is not much of an agreement among these so-called-economic-experts, then .... Am reminded of Casey Stengel, who said:

I think my sense is that the sentiment has been moving against this kind of approach both within the economics profession and more broadly. I think the initial view was that "yeah, this is a terrible situation" -- which I agree with -- "and we've got to do something about this, and maybe this will work." I think there was support in that sense.

"You look up and down the bench and you have to say to yourself, 'Can't anybody here play this game?'

Tuesday, February 03, 2009

How would you spend $3000?

You think I am nuts? Nope. The stimulus package, which is edging closer and closer to a trillion dollar mark, essentially means that is the amount per person in America. This is one huge amount. I probably will spend it on the following:

A spring break vacation to a warm place: $1000

Paint the outside of the home: I am sure it will be more than the remaining #2000.

I think these will generate good enough multipliers, won't they? Painting the home will mean hiring two to four people for, say, three or four days. Those guys will then go spend the money on consumer goods, and so on. Vacation will prop up airline and hotel usage, which will at least help stop their bleeding.

How will you spend your $3000, if the government says it will reimburse you for expenses up to that amount?

Monday, February 02, 2009

Fiscal responsibility

TODAY'S award for Best Shooting Self in Foot by a Political Spokesperson goes to Brendan Daly, a flack for Nancy Pelosi, the speaker of the House. The subject: Why 11 Democrats voted against the stimulus package.

Did the other 246 Democrats in the House campaign against fiscal responsibility? Did the new president? That's what's being implied here. But what Mr Daly is referring to is the way that some Democrats run against deficit spending as a way of blunting Republican attacks. The other members of their party roll their eyes but tolerate this, because once in office these Democrats don't prevent the majority from passing its spending. Mr Daly surely didn't mean to reveal this.The speaker has said many times that the members are representative of their district. Many of the districts are more conservative, and they campaigned on fiscal responsibility, and we understand that.

Monday, January 19, 2009

Spending our way into economic prosperity?

In fairness, we cannot assign all the blame to Mr Bush. Congress bears some responsibility, as do the American people. After all, in our constitutional republic it is “We the People” who are ultimately account able for what happens in Washington.

....

Any stimulus proposal should be timely, targeted and temporary. It should be large enough to make a difference, but not too large, and be properly structured in order to minimise waste. It should be designed to stimulate job growth and make targeted infrastructure and other investments to make America more competitive.

While some stimulus is called for, we cannot spend our way into economic prosperity, especially when all new spending is debt-financed. It was troubling to see one prominent incoming senior economic official refer to the Obama administration’s planned stimulus proposal as a “down payment” on the future. How can something be a down payment when there is no equity involved? This is an example of how words used in Washington do not always fit Webster’s definitions.

The president and Congress must put a process in place that will enable elected officials to reimpose tough statutory budget controls and reform our nation’s Social Security, Medicare, healthcare and tax systems. All these require significant reforms that Washington has delayed for too long. We also need a baseline review of all main spending and tax choices to re prioritise them to reflect 21st-century realities.

Tuesday, January 06, 2009

Bridges to nowhere?

the right infrastructure could provide the basis for a redirected economy. Long term, the most important investments are not on the easy list of "off the shelf" projects. Yes, good roads and bridges are important. But investing in the necessary public goods to support a post-hydrocarbon, information-based economy is a much better choice than using the stimulus to patch up the old economy.ps: speaking of Spitzer's sexcapades, read this horrible tragedy involving a man, his penis, and his jealous wife. He is dead, their house has been burned down--it all started from the wife setting fire to the husband's penis when he was asleep. If only we men learnt how to keep it inside our pants! Spitzer ought to thank his wife for sparing his life!

Is it President-Elect McCain or Obama?

So let’s get this straight: Robert Gates will be the Defense Secretary, we’re ramping up U.S. forces in Afghanistan and providing a reasonable period of time for a hand-off in Iraq, there isn’t going to be a windfall oil profits tax or income tax hike but there is going to be a huge set of business tax cuts – and Rick Warren is giving the invocation at the Inauguration. Who won in November?

I’m sure there will be times during the next four years when the Obama administration’s decisions on issues (e.g. judicial appointments) have conservatives banging their heads against the wall, bemoaning the fact that John McCain wasn’t elected. But so far it’s hard to imagine McCain would have been doing more than the incoming Obama team seems to be proposing — and with as much chance of success –to further some key center-Right policy aims.

Hmmmm.... Jennifer Rubin has a great observation there.