We rarely feel the need to alert readers to explicit content. But our discussion of the online sex trade requires frank language, and some may find the topic distasteful.Yes, the Economist!

The warning was in place for a good reason; it had charts like the one below and words that can be challenging when a kid is around:

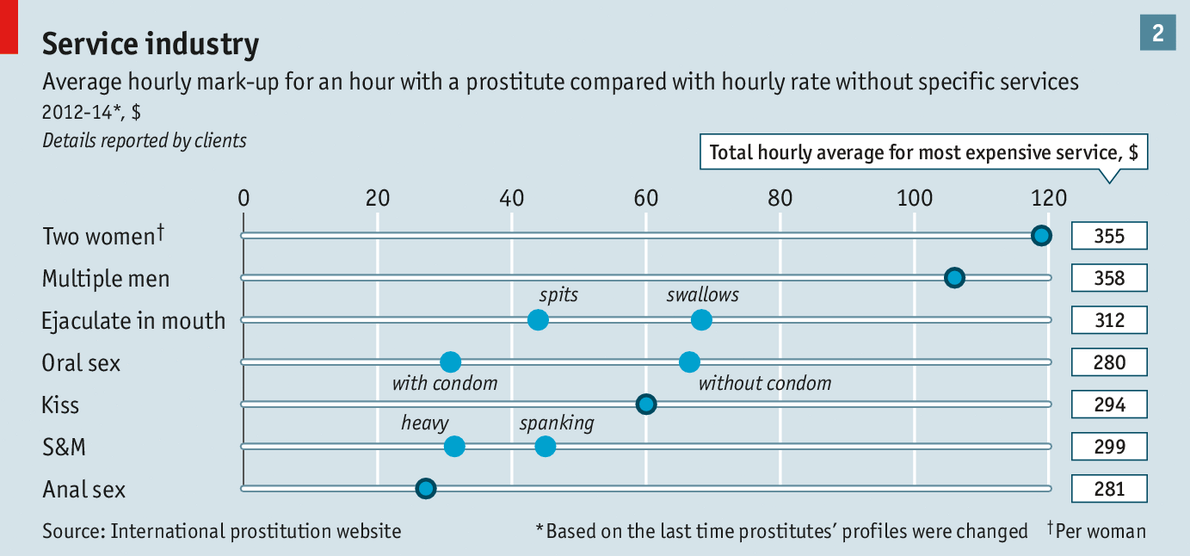

While the vast majority of us are clueless about this industry, we know well that sex is traded as much as various illegal drugs are. If you are like me, you wonder how they decide to price things? From a supplier perspective, how do they know what to charge? What if they are underpricing their services? What if they can raise their prices, have fewer customers, and still generate higher incomes? From a demand perspective, how do the Johns know what is a good deal? Do they comparison shop and, if they do, where are those prices listed?

You see how fascinating the world is? Every single day is about asking new questions, and finding out that I have no clue whatsoever!

The magazine noted,

Women who are considering entering the industry often seek advice online from those already in it before making up their minds.Today, I read in another British publication, The New Statesman, which historically has been way left of the Economist, in which a porn actor. Stoya, writes about the need for transparency in how actors are paid.

one thing we rarely talk about openly is pay. Which makes us a lot like many other workers.Are you thinking about what I am thinking? How do they even find out about the job openings in the first place? The magic of the "invisible hand," I suppose!

A well-known performer who had her heyday in the late 2000s once told me that her rate for a double penetration scene was $12,000. I’d just started performing and was under exclusive contract with a single studio – a situation much more like being a direct employee than an independent contractor – and had no experience with agencies or booking my own freelance gigs to check this figure against.Studio contract? Independent contractor? Freelance gigs? WTF is doubly appropriate here ;)

Her rate seemed plausible, though – being penetrated by two male-bodied people at the same time, one in the anus and one in the vagina, certainly seemed to carry a higher risk of mechanical trauma. Double penetration scenes were rare, as were performers willing to be the receptive partner in them, and rarity tends to add value in any market.

So, when I decided that I wanted to perform in a double penetration scene and the owners of the studio I was with asked how much I wanted to be paid for it, I told them I wanted $12,000. We settled in the middle. Years later it turned out that the performer who had set my expectations so exorbitantly high was actually paid 12 – or possibly 14 – hundred dollars for those sorts of scenes.

She writes that "the lack of transparency around rates and my belief in an outrageous lie worked in my favour." How does the market put a price on a sex act? This is way too bizarre!

Capitalism, near as I can tell, involves a lot of companies trying to get as much out of a worker as they can for as little pay as possible. In these relationships, the worker should aim for the most pay they can get for the least work. There’s a very important emphasis on “can get”, though, because a luxuriously high rate does absolutely no good if no one is able or willing to pay it.Stoya articulates one of the toughest issues in market economics--pricing. That mystery of the marketplace is also why Google hired away an authority on pricing as its Chief Economist. Yes, the World Bank and the IMF have Chief Economists, and so does Google!

Why does Google even need a chief economist? The simplest reason is that the company is an economy unto itself. The ad auction, marinated in that special sauce, is a seething laboratory of fiduciary forensics, with customers ranging from giant multinationals to dorm-room entrepreneurs, all billed by the world's largest micropayment system.I don't suppose Google and Varian will want to help out Stoya ;)

Google depends on economic principles to hone what has become the search engine of choice for more than 60 percent of all Internet surfers, and the company uses auction theory to grease the skids of its own operations. All these calculations require an army of math geeks, algorithms of Ramanujanian complexity

|

| Source |

3 comments:

That's the beauty of markets. Price discovery happens in stranger and more difficult fields. How do you price an oil rig firefighting expert. Ditto exorcist. All of these happen between a willing seller and a willing buyer - even if there are not many comparable transactions.

If you can price a reverse repo Nikkei futures transaction, you can price anything !!

Nikkei futures were the undoing of Baring's bank :)

There's far more esoteric stuff out there now.

Yes, the magic of the market ... a magic that the Soviet non-price system couldn't match ...

As for the Nikkei stuff, that is way, way above my head ;)

Post a Comment